Preparing for Tomorrow, Today: Why Communities Need Strategic Reinvestment

Reinvestment Fuels Sustained Growth

As an economic development consultant, I've seen firsthand how reinvestment fuels sustained growth. It sparks innovation by transforming productive assets into profits. Consider the ethos of 'Shark Tank'—people praise entrepreneurs for reinvesting earnings into their ventures rather than taking large personal rewards. Why? Because seasoned investors know businesses need nurturing during their germination period. This nurturing happens through reinvestment.

This philosophy extends beyond the corporate sphere into community development. Site selection consultants look for evidence of forward-thinking investments, like the due diligence of the "Sharks." Communities that have invested in themselves stand out. Investments may include acquiring key land parcels, improving infrastructure, or enhancing quality of life through parks and recreation.

Understand Community Assets for Informed Reinvestment

Understanding a community's unique features through market data is crucial for informed reinvestment and strategic growth. Not all communities are created equal. While an direct access to an interstate may no longer be a "non-negotiable", a community's suitability for specific industries remains paramount. At MWM, our experience with industrial and manufacturing projects has shown that each community has its own readiness based on existing industries, workforce skills, educational facilities, infrastructure, and location. This critical information guides recommendations on property acquisition and target industries most likely to succeed. It highlights which sectors align with community assets and industry needs. Getting this puzzle right leads to mutual prosperity.

Use Resources Strategically With Long-Term Goals

Currently, funding for economic development is plentiful, but the art is not simply securing funds - it's deploying them with intent. For instance, Kentucky Cabinet for Economic Development's $100 million Kentucky Product Development Initiative (KPDI) and Ohio’s $750 million All Ohio Future Fund require strategic action within a limited timeframe. There are also major funds available in Indiana that communities can leverage.

These funds represent an unprecedented opportunity, but they should be taken advantage of judiciously during their short window of availability. It’s mission-critical to apply with a robust ROI model, not “just because the funds are available.” What is the market demanding from a utility perspective within the target industry a community is focused on? How many acres does that industry, on average, need when acquiring a new site? Those data points should be clearly defined within funding applications.

Robust ROI modeling should guide resource allocation, not a rushed impulse to capitalize on availability. Market data on land requirements and utility needs of target industries should underpin funding applications and community investments. Avoiding impulsive investments in favor of data-driven, goal-aligned decisions is key to sustainable development.

Growth Through Partnerships

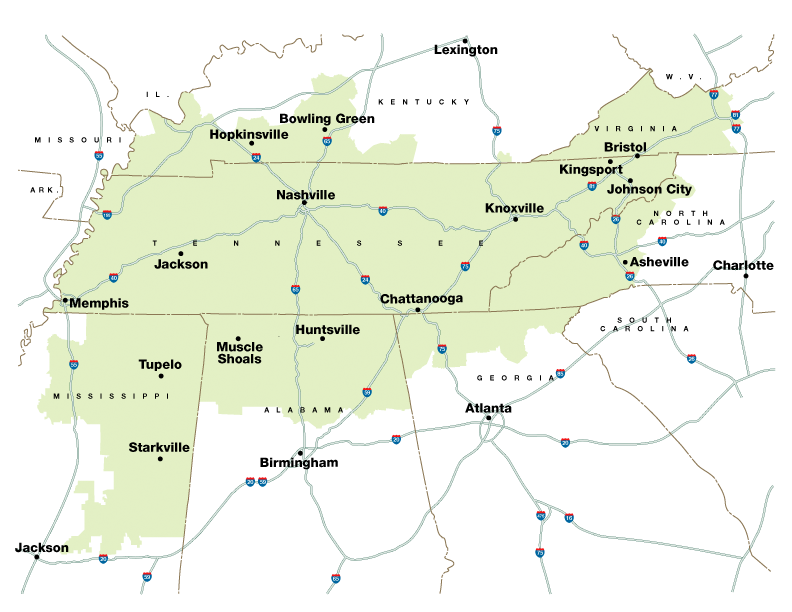

Programs like KPDI and the Tennessee Valley Authority's InvestPrep demonstrate the power of strategic funding and partnerships to boost communities. With TVA overseeing 28 Kentucky counties, KPDI and InvestPrep synergize for maximum impact. In particular, InvestPrep offers up to 70% match on projects, encouraging more ambitious efforts. This expertise has led to over $15 million in endorsed funding and tangible outcomes like infrastructure, jobs, and economic revitalization.

The $500 million

Indiana Economic Development Corporation's

READI initiative has also catalyzed transformative regional projects, underscoring the narrative of strategic community investment. Upgrading infrastructure and preparing sites makes communities more attractive to investors and signals readiness to meet their needs. Following the lead of these successful programs by seeking expert guidance and leveraging available resources for strategic goals is key for growth.

Cultivating Tomorrow’s Prosperity

Think of strategic community reinvestment like nurturing a garden - it requires patience, planning, and investing resources today to reap the benefits tomorrow. Programs like KPDI, InvestPrep, and READI exemplify this philosophy by catalyzing economic growth and resilience. When matched with a community's vision, strategic funding enhances infrastructure, jobs, and quality of life. Like dominos, reinvestment touches every facet of community life to promise a brighter future.

At MWM, our expertise in strategic consulting has helped numerous communities leverage funding programs to maximize growth and development. We aim to provide the insight and guidance communities need to make intelligent investment decisions. MWM has directly assisted on projects using initiatives like KPDI and InvestPrep by advising on millions in grant funding and telling our clients' stories effectively.

Communities at a crossroads must look to these success stories for inspiration to craft data-driven investment plans. The road to revitalization starts with bold reinvestment fueled by strategic decisions. This journey promises a legacy of growth, opportunity, and prosperity, extending beyond any single project.